Capital Gains Rate 2025 - Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, That's up from $44,625 this year. Capital gains tax rates and allowances. Current Us Long Term Capital Gains Tax Rate Tax Walls, Biden is proposing to increase the 3.8%. That would mean capital gains for those earning at least $1 million would be taxed at a base rate of 39.6%, up from 20%.

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, That's up from $44,625 this year. Capital gains tax rates and allowances.

The irs may adjust the capital gains tax rate each year.

How to Calculate Capital Gains Tax on Real Estate Investment Property, See how the gains you make when selling stocks will be impacted by capital gains taxes in your. The capital gains tax rate that applies to profits from the sale of stocks, mutual.

Understanding the Capital Gains Tax A Case Study, Ask a financial professional any. The capital gains tax rate that applies to profits from the sale of stocks, mutual.

Budget 2023 Will longterm capital gains exemption limit go up?, What is capital gains tax in india? In 2025, individuals' taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.

Capital Good points Tax Brackets For 2023 And 2025 Nakedlydressed, Biden is proposing to increase the 3.8%. Capital gains tax rates for 2025.

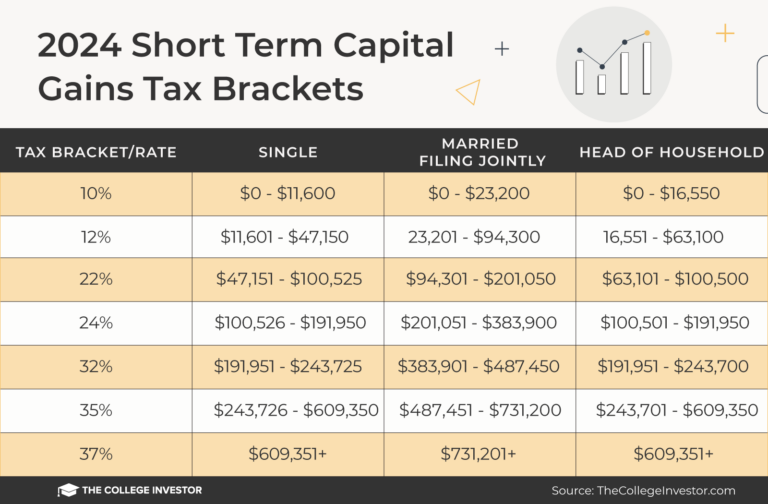

Short Term Capital Gains Tax EQUITYMULTIPLE, 2) how long you held the investments. Biden is proposing to increase the 3.8%.

Capital Gains Tax Brackets For 2023 And 2025, Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. 2) how long you held the investments.

Capital Gains Rate 2025. 1) the amount your investments have increased in value. That's up from $44,625 this year.

2025 Va Tax Brackets Latest News Update, Capital gains tax rates and allowances. Capital gains rates for individual increase to 15% for those individuals with income of $44,626 and more ($89,251 for married filing joint, $44,626 for married filing separate,.

The Best To Live A Great Life, The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains are the profit from selling an asset, such as a stock, mutual fund, or etf.

Any profit or gain that arises from the sale of a ‘capital asset’ is known ‘income from capital. In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.