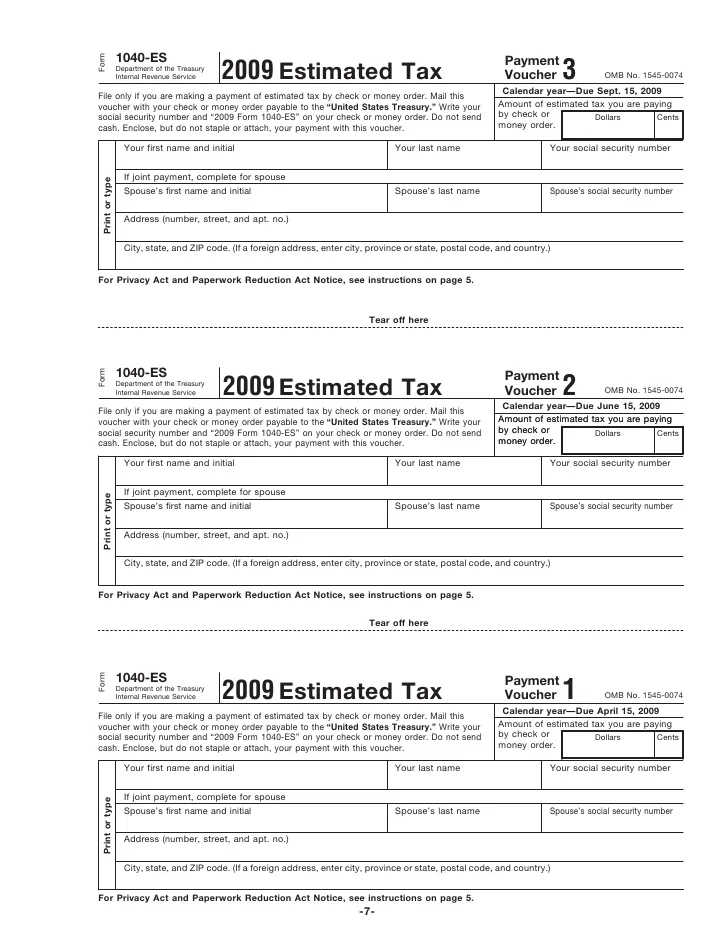

When Are Iowa Estimated Taxes Due 2025 - Due date of filing a federal tax return or requesting an extension for most of the nation. Irs Quarterly Payment Due Dates 2025 Lucia Inesita, The federal federal allowance for over 65 years of age married (joint) filer in 2025 is $ 1,550.00. Due date of filing a federal tax return or requesting an extension for most of the nation.

Due date of filing a federal tax return or requesting an extension for most of the nation.

2025 Tax Deadlines for the SelfEmployed, The deadline to file your federal income tax return is rapidly approaching, so save yourself the scramble and familiarize. Irs begins processing 2023 tax returns.

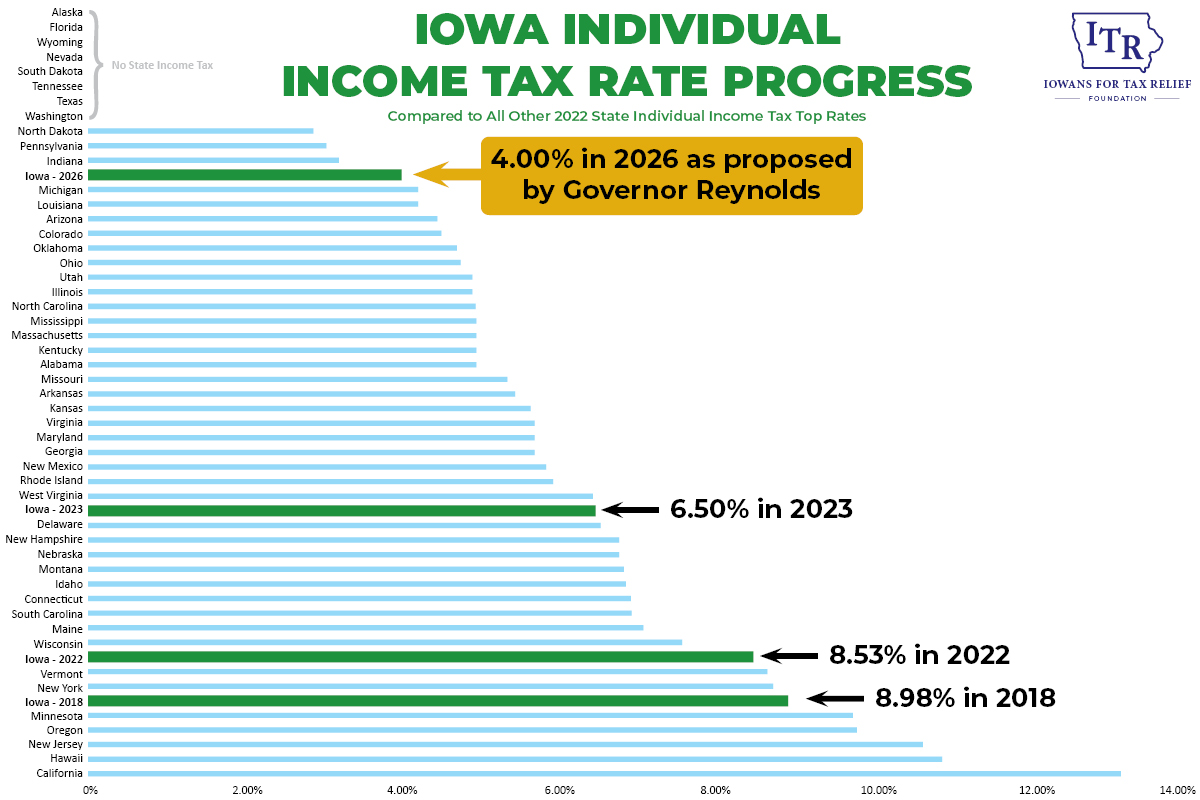

When Are Iowa Estimated Taxes Due 2025. The federal federal allowance for over 65 years of age married (joint) filer in 2025 is $ 1,550.00. Iowa individual estimated income tax instructions tax.iowa.gov.

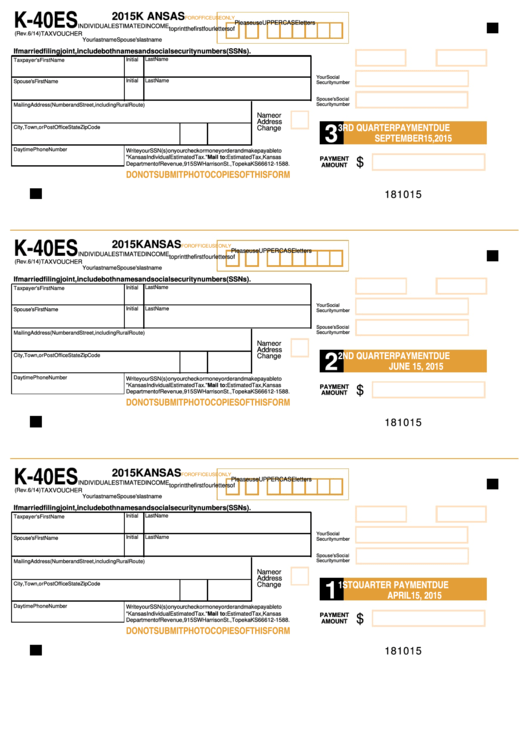

Irs Estimated Tax Payment Form 2025 Deana Estella, Estimated tax payments should be made: Once you input your income, the calculator will automatically apply the current tax rates and brackets for 2025 to determine the amount of income tax due.

Iowa Estimated Tax Forms 2025 Nancy Valerie, The federal standard deduction for a married (joint) filer in 2025 is $ 29,200.00. Filing season start date for individual tax returns.

When Are Iowa State Taxes Due 2025 Raina Carolann, Estimated tax payments should be made: The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Iowa individual estimated income tax instructions tax.iowa.gov.

Iowa State Tax Deadline 2025 Gene Peggie, The deadline to file your federal income tax return is rapidly approaching, so save yourself the scramble and familiarize. Irs begins processing 2023 tax returns.

Iowa Estimated Tax Forms 2025 Nancy Valerie, And is based on the tax brackets of 2023 and. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Iowa Estimated Tax Payments 2025 Dates Cherie Fernande, The iowa state tax calculator (ias tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.to estimate your tax return for 2025/25, please select the 2025 tax. Estimated tax payments are made:

Iowa Tax Return 2025 Nelly Yevette, Once you input your income, the calculator will automatically apply the current tax rates and brackets for 2025 to determine the amount of income tax due. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

The iowa state tax calculator (ias tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.to estimate your tax return for 2025/25, please select the 2025 tax.